Nongrantor Lead Trust

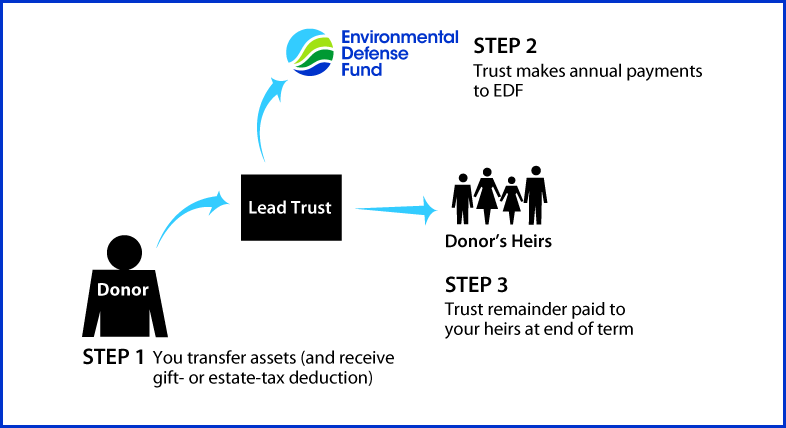

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years) and transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes annual payments to EDF

- Remainder transferred to your heirs

Benefits

- Annual gift to EDF

- Future gift to heirs at fraction of property's value for transfer-tax purposes

- Professional management of assets during term of trust

- No charitable income-tax deduction, but donor not taxed on annual income of the trust

More Information

Request an eBrochure

Request Calculation

Contact Us

Toll-free: 877-677-7397 |

Environmental Defense Fund |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Gift planning

- Welcome to planned giving

- What to give

- Osprey Legacy Society

- Donor stories

- Gift Intention Form

- Most popular options

- Life stage gift planner™

- Compare gift options

- Request a calculation

- Bequest language

- For professional advisors

- How do we use your gifts

- Blog

- Meet our staff

- Contact us

- Glossary